Navigating the U.S. Housing Market Shortage: What It Means for Arlington, Bethesda, Chevy Chase, Falls Church, McLean, Potomac, Vienna, and Washington DC

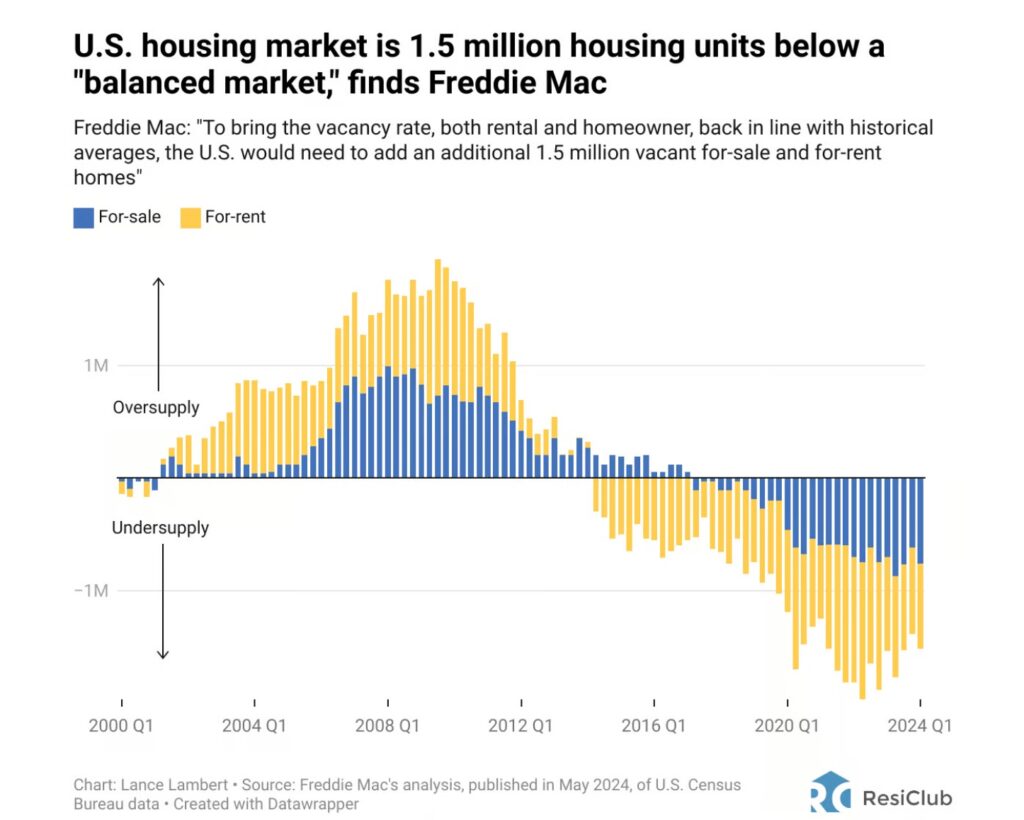

The recent analysis by Freddie Mac reveals that the U.S. housing market is currently 1.5 million units below a balanced market, highlighting a significant undersupply of homes available for sale and rent. This trend has critical implications for both buyers and builders, especially in high-demand areas like Arlington, Bethesda, Chevy Chase, Falls Church, McLean, Potomac, Vienna, and Washington DC.

Understanding the Housing Market Imbalance

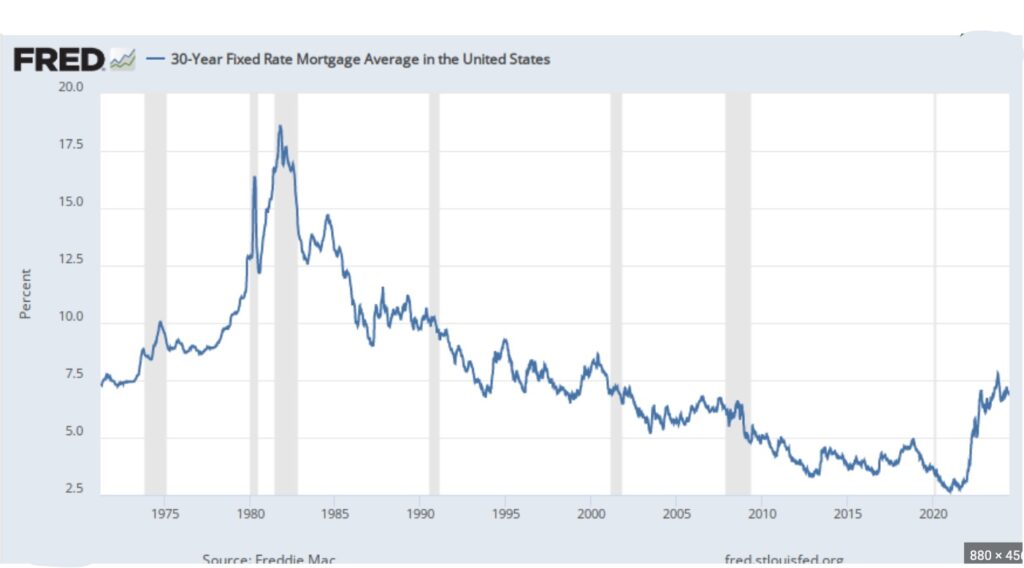

The Freddie Mac report emphasizes that the current housing market is characterized by a notable undersupply. Historically, the market has fluctuated between periods of oversupply and undersupply, with significant peaks and valleys.

Since the 2008 financial crisis, the market has seen a continuous reduction in the number of available housing units, culminating in the current shortage.

This shortfall means that demand for homes outstrips supply, driving up competition and prices.

What This Means for Home Buyers in the DMV Area

For potential home buyers in Arlington, Bethesda, Chevy Chase, Falls Church, McLean, Potomac, Vienna, and Washington DC, this market imbalance means higher competition for fewer available homes.

Buyers need to be prepared to act quickly and decisively to secure their dream home.

Partnering with a knowledgeable real estate developer and having financing pre-approved can provide a significant advantage in this competitive market.

Opportunities for Custom and Speculative Home Building

As a leading builder of custom and speculative homes in these sought-after areas, Paramount Construction, Inc. is uniquely positioned to address this housing shortage.

Here’s how:

Largest List of Tear Down Lots

We have the largest list of teardown lots in Arlington, Bethesda, Chevy Chase, Falls Church, McLean, Potomac, Vienna, and Washington DC.

This extensive selection ensures that your new home will be located in a prime spot with access to excellent schools, amenities, and vibrant communities.

Custom Homes Tailored to Your Needs

We specialize in designing and building luxury custom homes that cater to the specific needs and preferences of our clients.

Our team works closely with you to create a home that reflects your unique style and meets your highest standards of quality and comfort.

Speculative Homes Ready for Purchase

In addition to custom homes, we also build speculative homes designed to meet the demands of discerning buyers. These homes are under construction or move-in ready, offering modern amenities, high-quality construction, and beautiful design.

Innovative Building Practices

Our commitment to using the latest building technologies and sustainable practices ensures that your custom or speculative home is not only beautiful but also energy-efficient and environmentally friendly.

The Benefits of Building or Buying a Home in an Undersupplied Market

In a market with limited available housing, building a custom home or purchasing a speculative home offers several distinct advantages:

- Personalization: With custom homes, you have the freedom to design every aspect of your home, from the layout and architectural style to the finishes and fixtures.

- Modern Amenities: Both our custom and speculative homes are equipped with the latest technologies and conveniences, offering a higher quality of living.

- Investment Value: Homes in desirable locations like Arlington, Bethesda, Chevy Chase, Falls Church, McLean, Potomac, Vienna, and Washington DC tend to appreciate in value, making them a sound investment.

Partner with Paramount Construction, Inc. for Your Custom or A Home Under Construction

Navigating the current housing market can be challenging, but with Paramount Construction, Inc., you have a trusted partner dedicated to making your dream home a reality.

Our expertise in custom and speculative home building, combined with our extensive list of teardown lots, makes us the ideal choice for discerning buyers looking to build or purchase a luxury home in these prestigious communities.

Contact us today to learn more about our custom and new homes under construction building services and how we can help you take advantage of the opportunities in the current housing market. Let’s build the home of your dreams in the DMV area.

Here’s a related post about the imbalance for new homes in Washington DC.

Looking for building lots in the DC area?

More new homes under construction for sale and lots for sale:

*Chevy Chase – 4812 Chevy Chase Blvd. – downtown Bethesda – under construction

*McLean – 15K SF lot – McLean HS – private list – call or text to learn more 301-370-6463

*Bethesda – 1/2 Acre – Churchill HS – private list – call or text to learn more 301-370-6463

*McLean – 17,800 SF Flat lot – McLean HS

*Bethesda 6008 Kirby Road – 12,700 SF lot – Walt Whitman HS – new home to be built

*N. Arlington 6317 Street N. – 13,000 SF – Yorktown HS – new home to be built

*Bethesda 6820 Marbury Road – 11,500 SF lot – Walt Whitman HS – under construction

*Bethesda – 4922 Earlston Dr. – Bethesda blocks to Westbard Square – under construction

New Home Services:

*Access our wholesale acquisitions list & beat the competition – call 301-370-6463

*How much does a new home cost? Find out here