Washington DC, Maryland or Virginia – Which Has Most Favorable Tax Rates When Selecting A New Home Site?

Comparing Real Estate Property Taxes, Income Taxes, and Estate Taxes in Washington DC, Maryland, and Virginia

If you are considering the impact on taxes when choosing between Washington DC, Maryland and Virginia when choosing a new home building site, you may find this article interesting.

When choosing a new home site, one of the most critical considerations is the tax impact. Property taxes, income taxes, and estate taxes can significantly affect your overall cost of living and financial planning. This article provides an overview of the real estate property taxes, income taxes, and estate taxes in Washington DC, Maryland, and Virginia to help you make an informed decision.

It is difficult to provide a definitive answer to that question, as taxes can vary depending on several factors, including the specific location within the District of Columbia (DC), Maryland, or Virginia, as well as the individual’s income and property value.

Additionally, tax laws and rates can change over time, so it is important to consult with a tax professional or do your research to determine the current tax situation in any given location.

Real Estate Property Taxes

Washington DC

Washington DC has some of the highest property taxes in the country. The property tax rate in DC is approximately 0.85% of the assessed home value. For a home valued at $2.5 million, you can expect an annual property tax bill of around $21,250.

Maryland

Montgomery County

Montgomery County, one of the wealthiest counties in Maryland, has a property tax rate of about 1.05% of the assessed home value. For a home valued at $2.5 million, the annual property tax bill would be approximately $26,250. This rate can vary based on specific municipalities within the county.

General Maryland Overview

Maryland’s property tax rates vary by county. On average, the property tax rate in Maryland is about 1.10% of the assessed home value. For a home valued at $2.5 million, the annual property tax bill would be approximately $27,500.

Virginia

Fairfax County

Fairfax County, known for its high quality of life and excellent public services, has a property tax rate of approximately 1.14% of the assessed home value. For a home valued at $2.5 million, the annual property tax bill would be around $28,500.

Arlington County

Arlington County, with its proximity to Washington DC, has a property tax rate of about 1.013% of the assessed home value. For a home valued at $2.5 million, the annual property tax bill would be approximately $25,325.

General Virginia Overview

Virginia generally has lower property tax rates compared to DC and Maryland. The average property tax rate in Virginia is around 0.80% of the assessed home value. For a home valued at $2.5 million, you can expect an annual property tax bill of about $20,000.

Income Taxes

Washington DC

Washington DC has a progressive income tax system with relatively high rates. The income tax rates range from 4% to 10.75%, depending on your income bracket. For an annual income of $500,000, the tax rate is approximately 8.95%, leading to a substantial tax burden.

Maryland

Montgomery County

Montgomery County residents pay the Maryland state income tax, which ranges from 2% to 5.75%, plus a county income tax rate of 3.2%. For an annual income of $500,000, the combined state and county tax rate is around 8.95%.

General Maryland Overview

Maryland also has a progressive income tax system, with rates ranging from 2% to 5.75%. Additionally, each county imposes a local income tax, which can add an extra 1.75% to 3.20% to your tax rate.

Virginia

Fairfax County

Fairfax County residents pay the Virginia state income tax, which ranges from 2% to 5.75%. Unlike Maryland, there are no additional local income taxes in Virginia.

Arlington County

Arlington County residents also pay the Virginia state income tax, with no additional local income taxes.

General Virginia Overview

Virginia’s income tax system is progressive, with rates ranging from 2% to 5.75%. For an annual income of $500,000, you would be subject to the top state tax rate of 5.75%.

Estate Taxes

Washington DC

Washington DC imposes an estate tax on estates exceeding $4 million, with rates ranging from 11.2% to 16%. This can significantly impact high-net-worth individuals planning their estate.

Maryland

Maryland is one of the few states that imposes both an estate tax and an inheritance tax. The estate tax applies to estates exceeding $5 million, with rates ranging from 0.8% to 16%. Additionally, the inheritance tax is generally 10% on amounts passed to non-lineal descendants.

Virginia

Virginia does not impose an estate tax or inheritance tax, making it more favorable for estate planning compared to DC and Maryland.

Additional Considerations

Auto Taxes

When selecting a home site, it’s also essential to consider auto taxes. DC imposes a higher vehicle excise tax compared to Maryland and Virginia, which can add to your overall tax burden if you own high-value vehicles.

Personal Property Taxes

Virginia imposes personal property taxes on vehicles, which can vary significantly by county. Maryland and DC do not have this tax, potentially making them more attractive if you own several or high-value vehicles.

Conclusion

Choosing where to build your new home involves evaluating various factors, with taxes being a significant consideration. Here’s a quick summary:

- Property Taxes: DC tends to have the highest property taxes, followed by Maryland and then Virginia.

- Income Taxes: DC and Maryland have higher income tax rates compared to Virginia.

- Estate Taxes: Maryland and DC impose estate taxes, while Virginia does not.

- Other Taxes: Consider additional taxes like auto and personal property taxes when making your decision.

Ultimately, the best choice depends on your specific financial situation and lifestyle preferences. Consulting with a tax professional can provide personalized advice and ensure you understand the current tax laws and rates for each location.

If you need more information or are ready to explore home sites in these areas, don’t hesitate to contact us at Paramount Construction. We offer the largest selection of new homes and building lots in Bethesda, Chevy Chase, Arlington, McLean, Falls Church, and Northwest Washington DC.

Contact Us

Paramount Construction Phone: 301-370-6463 Email: info@paramountconstruction.net or schedule a New Home Strategy Call here.

Please note: Tax rates and laws are subject to change. For the most current information, please consult your tax advisor.

Sources

District of Columbia Office of Tax and Revenue

This site provides information on property taxes, income taxes, and estate taxes for residents of Washington DC. It includes tax rates, payment options, and resources for understanding your tax obligations.

Maryland Department of Assessments and Taxation

This site offers detailed information on property assessments and property tax rates in Maryland. It provides tools for property owners to understand and appeal their property assessments.

Virginia Department of Taxation

This site provides comprehensive information on Virginia’s tax system, including income taxes, property taxes, and estate taxes. It includes tax forms, filing instructions, and tax rates.

Montgomery County, MD – Property Taxes

This section of the Montgomery County government website provides information on property tax rates, payment methods, and property assessment details specific to Montgomery County, Maryland.

Fairfax County, VA – Property Taxes

This part of the Fairfax County website provides details on property tax rates, assessment methods, payment options, and property tax relief programs for residents of Fairfax County, Virginia.

Arlington County, VA – Property Taxes

This section of the Arlington County website offers information on property tax rates, assessment processes, payment schedules, and tax relief programs available to Arlington County residents.

District of Columbia Office of Tax and Revenue

(Repeated) This site provides information on property taxes, income taxes, and estate taxes for residents of Washington DC. It includes tax rates, payment options, and resources for understanding your tax obligations.

Maryland Comptroller of the Treasury

This site provides information on Maryland’s state income taxes, sales taxes, and estate taxes. It includes tax forms, filing guidelines, and tax payment options.

Virginia Department of Motor Vehicles

This site provides information on vehicle registration, titling, and taxes in Virginia. It includes details on vehicle excise taxes, personal property taxes, and other fees associated with vehicle ownership.

District of Columbia Office of Tax and Revenue – Estate Taxes

This section specifically addresses estate taxes in Washington DC, including rates, exemptions, filing requirements, and payment options for estates subject to DC’s estate tax.

Maryland Comptroller of the Treasury – Estate Taxes

This part of the Maryland Comptroller’s site provides information on Maryland’s estate tax, including rates, thresholds, filing instructions, and exemptions for estates.

Virginia Department of Taxation – Estate Taxes

This section of the Virginia Department of Taxation’s website provides information on estate taxes, though Virginia does not impose an estate tax. It offers resources for understanding related federal tax obligations and estate planning.

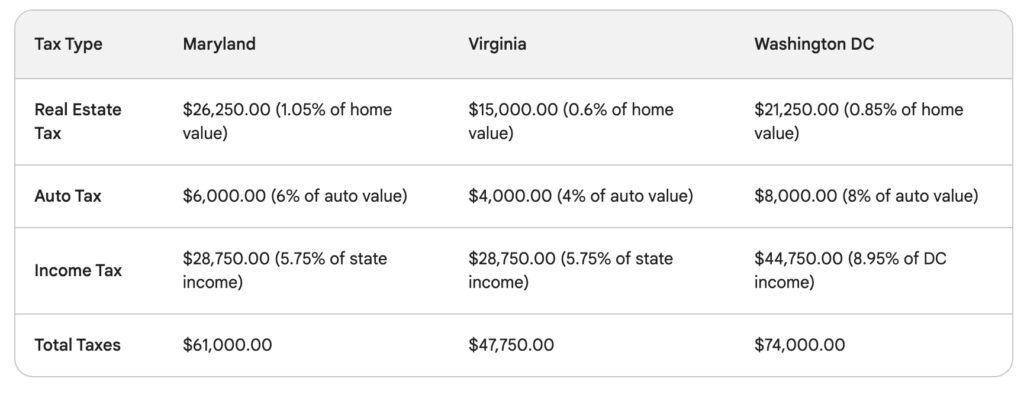

Real estate taxes, auto taxes and income tax considerations. Assumptions: home price is $2.5M income is $500K and Auto values are $100K. Disclaimer: these may not be accurate and it’s best to consult your tax advisor before making any decisions.

Check this post in Reddit regarding whether DC residents still pay lower taxes than Maryland or Virginia Residents.