The Real Estate Dilemma: Lower Interest Rates and Higher Prices or Higher Rates and Lower Prices?

Discover which is best when buying a new home in a market with tight inventory like Washington D.C.

Are you thinking about buying a home in the current market? With interest rates hovering at record lows and home prices soaring, it can be an overwhelming decision to navigate. In this article, we will break down the pros and cons of buying a home at 3.5% with a 20% price increase and multiple offers versus a 6.5% rate. We will also provide tips to help you make the best possible decision for your situation.

Understanding the Current Housing Market

Before we dive into the different scenarios, it’s crucial to understand the current housing market. In many areas, demand is outpacing supply, resulting in bidding wars and skyrocketing home prices. As a homebuyer, this may create a sense of urgency to act quickly to secure a home before it’s too late. However, this eagerness may lead you to make a decision that could have long-term financial implications.

It’s important to note that the current housing market is not the same as it was a decade ago. The 2008 housing crisis resulted in a significant drop in home prices, leaving many homeowners underwater on their mortgages. However, the market has since recovered and is now experiencing a different type of boom.

Factors Influencing the Market

The current housing market is influenced by many factors. One key factor is the current state of the economy. As the economy recovers, more people are looking to invest in property, leading to high demand. Another significant factor is demographic changes, such as millennials entering the housing market for the first time, driving up demand. Additionally, the COVID-19 pandemic has had a significant impact on the housing market, with many people seeking larger homes or homes in more rural areas due to remote work opportunities.

Government policies also play a critical role in shaping the current housing market. Low interest rates, for example, can make it more affordable for homebuyers to secure a mortgage, while tax incentives can encourage investment in real estate. However, it’s important to consider the potential long-term implications of these policies, as they may contribute to the inflation of housing prices.

The Role of Interest Rates

Interest rates are a key factor to consider when purchasing a home. Lower interest rates, such as the current 3.5% rate, can make it more affordable to buy a home since it reduces your monthly mortgage payment. A higher interest rate, such as 6.5%, would increase your monthly mortgage payment, making it more difficult to afford a more expensive home. However, it’s essential to consider the long-term implications of the interest rate. A lower rate may lead to paying a higher price for the home, while a higher rate may result in lower overall costs in the long run.

It’s also worth noting that interest rates can fluctuate over time. While they may be low now, they could increase in the future, leading to higher monthly mortgage payments. It’s important to factor in potential interest rate changes when considering the affordability of a home.

In conclusion, understanding the current housing market is critical when considering purchasing a home. While the current market may create a sense of urgency to act quickly, it’s important to consider all factors, including interest rates and potential long-term implications, before making a decision.

The 3.5% Rate Scenario

Pros of Buying at a 3.5% Rate

Buying a home at a 3.5% interest rate can be an excellent opportunity, especially if you’re looking for a more affordable monthly mortgage payment. With a lower interest rate, your overall mortgage repayment could be significantly lower, leaving you with more financial flexibility to invest in other areas of your life.

Additionally, buying a home at a lower interest rate can help you build equity faster. Because a higher percentage of your monthly mortgage payment will go toward the principal balance, you’ll be able to pay off your mortgage quicker and increase your home equity faster.

Furthermore, a lower interest rate can make it easier for you to qualify for a larger loan amount. With a lower monthly payment, your debt-to-income ratio will be lower, making you a more attractive borrower to lenders.

Cons of Buying at a 3.5% Rate

One of the most significant cons of buying at a 3.5% interest rate is the high demand for homes. The current housing market is highly competitive, and as more buyers flock to take advantage of the low interest rates, multiple offers on homes have become more common. This can lead to bidding wars and higher prices, which may negate the benefits of the lower interest rate.

Another con to consider when buying a home in the current market is the possibility of a 20% price increase and multiple offers. In a competitive market, sellers are looking for the best offer, which could mean having to pay over the asking price to secure the home. This could lead to a significant financial burden in the long term, even with a lower interest rate.

Furthermore, buying a home at a lower interest rate may mean sacrificing some of the features you want in a home. With a competitive market, homes that meet all of your criteria may be harder to come by, forcing you to settle for a home that doesn’t quite meet all of your needs.

Navigating a 20% Price Increase and Multiple Offers

When navigating a 20% price increase and multiple offers, it’s essential to work with a knowledgeable real estate agent who can help you navigate the market and make informed decisions. Your real estate agent can help you assess the value of a home and determine if it’s worth paying over the asking price.

Additionally, it’s crucial to have a solid understanding of your budget and financial goals. While a lower interest rate may seem attractive, it’s essential to consider the long-term financial implications of a higher purchase price.

Overall, buying a home at a 3.5% interest rate can be an excellent opportunity for those looking to save money on their monthly mortgage payment and build equity faster. However, it’s crucial to navigate the competitive market carefully and make informed decisions to ensure you’re making a sound investment in your future.

The 6.5% Rate Scenario

When it comes to buying a home, the interest rate you secure on your mortgage can have a significant impact on your overall financial situation. One interest rate that you may come across is 6.5%. While this rate may seem high compared to today’s rates, there are both pros and cons to consider when buying a home at a 6.5% interest rate.

Pros of Buying at a 6.5% Rate

Despite the seemingly high interest rate, there are some pros to consider when buying a home at a 6.5% rate. For one, purchasing a home at a higher interest rate could potentially mean a lower purchase price due to less demand from buyers. This could be especially beneficial for buyers who are looking to purchase a home in a competitive market. Additionally, a higher interest rate could result in a lower overall cost in the long run since you won’t be paying as much for the home itself. This could be a major advantage for buyers who are looking to save money in the long term.

Cons of Buying at a 6.5% Rate

While there are some pros to consider, there are also some cons when it comes to buying a home at a 6.5% interest rate. One significant con of purchasing a home at a 6.5% interest rate is that it could lead to a higher monthly mortgage payment, making it more challenging to afford a more expensive home. This could be a major disadvantage for buyers who are looking to purchase a larger or more expensive home. Additionally, if you’re planning on selling the home shortly after purchasing it, it may be difficult to recoup your expenses due to potential lower demand from buyers.

It’s important to carefully consider both the pros and cons before making a decision on whether or not to purchase a home at a 6.5% interest rate. Ultimately, the decision will depend on your individual financial situation and goals.

Comparing the Two Scenarios

When considering purchasing a home, there are many factors to take into account. Two of the most important factors are the interest rate and the long-term investment potential of the home. In this article, we will explore the financial implications and long-term investment potential of both a lower and higher interest rate.

Financial Implications

While a lower interest rate may seem like the better option, it’s important to consider the long-term financial implications. A lower interest rate may allow for a more expensive home, but it could also result in paying a higher price for the home overall. This is because a lower interest rate means a longer loan term, which results in paying more interest over time. On the other hand, a higher interest rate may result in a lower overall cost in the long run. This is because a higher interest rate means a shorter loan term, which results in paying less interest over time. It’s essential to weigh these factors carefully to make the best decision for your situation.

Additionally, it’s important to consider other financial factors such as property taxes, homeowner’s insurance, and any potential home repairs or renovations. These costs can add up quickly and should be factored into the overall cost of the home.

Long-term Investment Potential

Another factor to consider when comparing the two scenarios is the long-term investment potential of the home. While a lower interest rate may allow you to purchase a more expensive home, it may not be the best investment in the long run. This is because a more expensive home may not appreciate in value as much as a less expensive home. Additionally, a more expensive home may have higher property taxes and maintenance costs, which can eat into any potential profits from selling the home.

Conversely, a higher interest rate could lead to a lower purchase price, translating to a better investment in the long run. This is because a lower purchase price means a lower overall cost of the home, which can result in a higher return on investment if the home appreciates in value over time. It’s important to consider the potential for the home to appreciate in value, as well as any potential renovations or improvements that could increase the home’s value.

In conclusion, when comparing a lower and higher interest rate, it’s important to consider both the financial implications and long-term investment potential of the home. By carefully weighing these factors, you can make an informed decision that will benefit you in the long run.

Tips for Homebuyers in a Competitive Market

Buying a home in a competitive market can be a daunting task. With so many other buyers vying for the same properties, it can be difficult to stand out and secure the home of your dreams.

Looking for a Bethesda property?

However, with the right preparation and strategy, you can increase your chances of success. Here are some additional tips to consider:

Preparing Your Finances

As mentioned before, preparing your finances is crucial when buying a home in a competitive market. This means more than just having a strong credit score and savings for a down payment. You should also consider getting pre-approved for a mortgage before you start house hunting. This will show sellers that you are a serious buyer and have already taken steps to secure financing for the home. Additionally, you should have a contingency plan in case you get outbid on your first choice home. This could mean being open to looking at homes in a slightly different location or adjusting your budget to accommodate a higher offer.

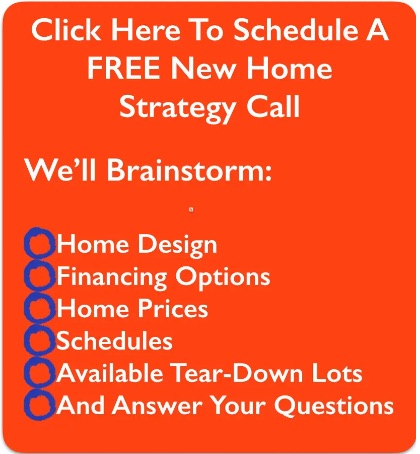

Working with a Real Estate Agent

While it’s possible to buy a home without a real estate agent, it’s not recommended in a competitive market. An experienced agent can provide valuable insights into the local market and help you make informed decisions. They can also help you act quickly when a new property becomes available and negotiate on your behalf to secure the best deal possible. When choosing an agent, look for someone who has a proven track record in competitive markets and understands your specific needs and preferences.

Making a Strong Offer

When it comes to making an offer on a home, it’s important to be strategic. In addition to offering a competitive price, consider including contingencies that are favorable to the seller. For example, you could offer to close the deal quickly or waive certain inspections. Additionally, consider writing a personal letter to the seller explaining why you love the home and why you would be the best buyer. This can help you stand out from other bidders and show the seller that you are committed to the home.

By following these tips and working with a knowledgeable real estate agent, you can increase your chances of success when buying a home in a competitive market. Remember to stay patient and persistent, and don’t get discouraged if it takes some time to find the perfect home. With the right preparation and strategy, you’ll be able to find a home that you love and that fits your budget.

Conclusion: Making the Right Decision for Your Situation

Buying a home in the current market is a significant decision that requires careful consideration. Whether you’re considering a 3.5% rate or a 6.5% rate, it’s essential to weigh the pros and cons carefully. By considering factors such as interest rates, housing market trends, and investment potential, you can make the best decision for your financial situation. And if you follow the tips for homebuyers in competitive markets, you’re well on your way to securing the home of your dreams.